Compare Invoice Finance Options for UK Businesses

Invoice finance (receivables finance) is a type of business funding that allows you to release cash immediately against unpaid sales invoices. This means you don't have to wait for your customers to pay you to get the money they owe you. This improves your cash flow.

Why Compare Invoice Finance Options Using FundInvoice?

- Unlock cash from unpaid invoices to improve your business cash flow.

- We compare multiple invoice finance providers in the UK to find the best fit & cost savings.

- Quick setup and fast access to funding.

- No obligation and no cost to you - the finance companies pay us.

GET MY FREE INVOICE FINANCE COMPARISON

To speak with an expert, please call Sean on 03330 113622 for a confidential invoice finance quote search, with no obligation.

Client Testimonial

This is a testimonial a client gave about using our service:

"I would have absolutely no hesitation in recommending your services and am very glad I found you!".

(Director of a testing company)

What Is Invoice Finance?

Invoice finance is a flexible funding solution that enables businesses to unlock the value of unpaid sales invoices. Instead of waiting for customers to pay, companies can receive up to 95% (even 100% minus fees in some cases) of the invoice value upfront. This can significantly improve cash flow and provide working capital for paying suppliers or funding business growth.

Invoice finance is a flexible funding solution that enables businesses to unlock the value of unpaid sales invoices. Instead of waiting for customers to pay, companies can receive up to 95% (even 100% minus fees in some cases) of the invoice value upfront. This can significantly improve cash flow and provide working capital for paying suppliers or funding business growth.

Definition

It is difficult to find an independent definition of invoice finance online, which can also be called receivables finance, factoring, invoice discounting, sales finance or supply chain finance. Wikipedia redirects you to the term "factoring", and the phrase does not appear in the dictionary. There are plenty of definitions from parties associated with the industry. A good definition is as follows:

"Invoice finance is a way for a business to borrow money based on

amounts due from customers that are businesses."

Invoice Finance Product Options

Whether you’re looking for invoice factoring, where the funder helps with credit control, or invoice discounting, where you stay in control of collections, invoice finance can be tailored to suit your needs.

At FundInvoice, we help businesses find competitive invoice finance quotes. We do not charge you directly. We compare providers, helping you save time and money.

- Funding based on your sales ledger

- Options for startups and growing businesses

- Fast approvals and flexible terms

Get a free invoice finance quote today to quickly unlock cash for your business.

See Our Invoice Finance Guide

For more detailed and in-depth information, please see our Invoice Finance Guide.

Get A Free Invoice Finance Quote Comparison

FundInvoice's multi-award-winning, independent, confidential service will help you:

- Save a substantial amount on quotes found elsewhere.

- Guide you through finding the receivables financing company that best meets your requirements.

- Help you move to an alternative provider if better terms are available.

- Find new invoice finance options if you have been declined or rejected for business finance elsewhere.

Perhaps you need help getting an invoice finance facility approved? If so, we can assist you and ensure you maximise your chances of approval.

We Don't Charge You

We will not charge you directly to use our service; if you decide to proceed, the finance provider will pay us a commission (included in the price).

- 98% of existing users told us they would recommend the service they received to other companies.

Some selective services allow you to dip in and out without any obligation to use them again and without giving a personal guarantee.

We have undertaken extensive market research to understand who offers the best prices and service levels. We will use our research to benefit you and save you from having to search the market for quotes.

An Injection Of Working Capital

Using this type of funding creates an injection of working capital into your business, which you can use for any purpose. You could use the extra money to:

- Finance expansion and growth

- Funding large orders or negotiating early settlement discounts from suppliers

- Purchase stock, materials or equipment

- Acquire or buy another business

- Pay off creditors, HMRC tax arrears or staff wages

Improve Business Cash Flow

Using business receivables financing will improve your business cash flow, as you will no longer have to wait for customers to pay. It will also help mitigate the effects of late payments. The other benefit is that your customers are still given credit terms, so you remain competitive. With the money you now have available, you might choose to negotiate supplier discounts for early payment, or you could choose to invest in expansion.

Raising The Funding Needed For Business

If you have a whole sales ledger of outstanding invoices to other businesses (B2B), you could raise a significant cash injection by cashing them all in. Alternatively, you can choose to get the funding needed for your business against just a few transactions that you select, without any ongoing obligation to use the service again. This selective approach can be useful if you only have an occasional need for extra business funding.

Find out more about When You Should Use Invoice Finance.

The Benefits Of Using Invoice Finance

Using invoice finance can offer a wide range of benefits to your business. Below is a comprehensive explanation of the key advantages:

- Improved Cash Flow - Invoice finance provides an immediate cash injection by unlocking the value of unpaid sales invoices. As you raise new invoices, further prepayments are released, meaning you no longer have to wait for customers to settle invoices. This boosts your working capital and creates consistent liquidity within your business.

- Greater Financial Flexibility - The additional working capital can be used for virtually any purpose — from paying pressing creditors, wages, or HMRC liabilities, to funding growth, taking on larger projects, or negotiating supplier discounts through cash payments.

- Funding for Strategic Transactions - Invoice finance can support mergers, acquisitions, management buyouts (MBOs), management buy-ins (MBIs), and takeovers, providing the capital needed to pursue strategic opportunities.

- Access for Businesses That Struggle With Traditional Finance - Companies that may not qualify for conventional funding, such as bank overdrafts or loans, often find invoice finance more accessible. Because the facility is secured against your receivables, providers can adopt a more flexible approach to approvals.

- Protection Against Bad Debts - Many facilities offer optional bad debt protection (non-recourse), helping to safeguard your business against customer insolvency or non-payment.

- Confidentiality Options - With confidential invoice financing, your customers need not know you're using a finance facility, maintaining your business’s professional image.

- Cost Savings Through Outsourced Credit Control - If you opt for factoring, the funder may provide a professional credit control service, saving you time and money on chasing payments.

- Export Invoice Collection Support - For exporters, some providers offer specialist support in collecting payments on overseas invoices, helping you manage international trade risks.

- Flexibility With Selective Use - Selective invoice finance allows you to use the facility only when needed, which is ideal for managing seasonal demand or irregular cash flow pressures.

- Additional Add-On Services - Some providers offer complementary services such as:

- Payroll management – simplifying employee payments.

- Trade finance – helping to pay for imported goods and raw materials.

- Online Account Management - Most providers offer secure online platforms where you can upload invoices, monitor transactions, and request drawdowns, giving you complete control and visibility.

For more independent guidance about how invoice finance works and its benefits, see the British Business Bank’s overview: Invoice Finance | British Business Bank

Successful Case Studies Using Invoice Financing

These are some example case studies where invoice financing has helped our clients:

Case Study 1: Recruitment Agency (Permanent to Temp Expansion)

Case Study: Finance Secured for Recruitment Agency Expanding into Temps

A permanent recruitment agency approached FundInvoice as they sought to expand into temporary placements but lacked the working capital to cover upfront wage costs.

We sourced a flexible solution that recognised the difference in risk between the two placement types. The agency secured a specialist recruitment financing facility offering different prepayment levels against the permanent placement and the temp invoices. This was tailored to support their evolving business model.

This blended funding enabled them to grow without relinquishing any control of their business or taking on debt.

Case Study 2: Manufacturer (Factory Owner’s Success Story)

Case Study: Manufacturer Secures Factoring When Others Failed

A UK manufacturing business struggled to access funding after multiple providers turned them away. They contacted FundInvoice, seeking someone who would take the time to understand their situation.

Using our network and experience in the manufacturing sector, we arranged an invoice factoring facility that met their cash flow needs and helped them move forward. This was their testimonial:

“As a result of their knowledge and persistence, Sean at FundInvoice were able to secure Invoice Factoring for us where others had failed. Working in a niche sector and on a complicated project, FundInvoice made the correct recommendations and supported me throughout the process. I am sincerely thankful for their help”

- MD of a UK-based Manufacturing Company

- Read more about invoice finance for manufacturers

See more case studies.

If you are ready to explore your own funding options call us on 03330 113622 for a discussion in confidence.

How Does Invoice Finance Work?

So, how does invoice financing work? Below are the key aspects of how it operates. However, bear in mind that there may be differences between providers.

This is how business invoice finance works (also called IF for short): it generates working capital and improves your cash flow by:

- Releasing money from the cash tied up in your outstanding sales transactions (invoices or payment applications). This could range from 70% up to 100% (minus fees) but is typically around 85-95% of the transaction value, depending upon your circumstances and industry sector.

- Allowing you to select transactions to get funded or to get funding against your entire sales ledger.

- Funding all your transactions gives you the maximum cash injection immediately.

- Releasing more funding each time you raise new invoices so the cash generated grows in line with your sales.

It can also:

- Generate increased funding levels as your turnover and, hence, your sales ledger grow. Bank loans and overdrafts are fixed, so they do not work this way.

- Provide optional help with credit control activity (or you can retain this in-house if you prefer).

- Provide optional protection against customer bad debts.

Revolving Finance

Unpaid sales are often a business's largest and most valuable asset. However, they are also frequently overlooked when raising money. This form of funding addresses this by providing revolving finance against the business's outstanding unpaid sales invoices.

"Revolving finance" means that if your sales ledger is fairly stable regarding the overall value of outstanding debts, the funding level remains constant or even increases as you expand. As old transactions are paid off (paying off the associated funding), new transactions replace them, and growth can increase your available money. As the overall value of your sales ledger increases, so does the amount of funding generated by the prepayment percentage, e.g. 85-95% of the value of your overall debt ledger.

This is a huge advantage over traditional static forms of finance. See our article about the Comparison Between Loans and Invoice Finance.

Selective Invoice Finance

If you don't want to fund all your transactions, choose "selective invoice finance" and pick which invoices you want to receive a prepayment against. You might select batches of transactions or just a single invoice or order. There can be no minimums, so you never have to use it again unless you choose to.

Instant Invoice Finance

If you need the funding in place quickly, some options can be very fast. We have completed almost instant invoice finance arrangements for some sectors, with a record of 7 hours from initial enquiry to money being received into the client's bank account. Typically, setup can be completed within a few days, but the providers will work on a timescale that suits you.

How Prepayments Grow With Your Business

Immediately you raise new invoices (or applications for payment in the construction sector), the funder will provide a prepayment (also known as an initial payment, or early payment) against the gross value of the sale. The financier will provide further prepayments as subsequent sales are made. In this way, the level of funding grows as your business grows, and it can dramatically improve your cash flow.

Our research found that 87% of existing users of these services said that it enabled their business growth.

The Process Of Invoice Financing

The detailed process of invoice financing is described below. This can apply to single transactions or batches of transactions.

In straightforward terms, this is how it works:

- Goods or Services Delivered - You supply goods or provide services to your customers as normal.

- Invoices Issued - You raise invoices on credit terms (e.g. 30 days), meaning the customer is not required to pay immediately.

- Invoices Submitted to the Financier - You submit your invoices to the invoice finance provider. This is usually done electronically, either by uploading individual invoices or by submitting your full sales ledger via your accounting software.

- Initial Funding Released - The financier advances a percentage of the invoice value, typically up to 95%, usually within 24 hours.

- Credit Control (Optional) - You can either manage the credit control yourself or have the financier handle it. If factoring is used, the financier will typically chase payment on your behalf.

- Customer Payment Received - Your customer pays the invoice amount into a bank account controlled by the financier.

- Remaining Balance Paid to You - Once the invoice is paid in full, the financier releases the remaining balance (e.g. the final 5%), minus their fees and applicable charges.

- Confidential or Disclosed Options - This process can be arranged confidentially, so your customers are unaware of the financier’s involvement, or disclosed, with or without credit control conducted in your business's name.

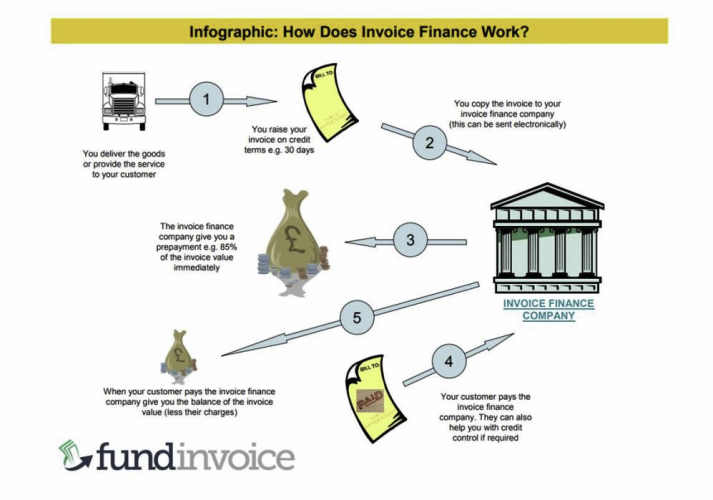

Process Infographic

The infographic below answers the question "How does invoice finance work?" by showing an overview of the process:

How Much Cash Could You Raise?

Funding percentages can be up to 100% of the transaction value (minus charges), but as an example, let's assume a prepayment of 85 to 95% of the gross transaction value. If your business has an outstanding sales ledger of £100,000 and, for example, say the funder agrees on a prepayment percentage of 85%, your business could receive up to £85,000 of cash funding immediately, at 95%, that would be £95,000. The balance of the sale value is STILL PASSED TO YOUR BUSINESS once it is paid, less the funder's charges.

To find out how much cash you could raise using invoice funding, use our free invoice finance calculator.

Funding Levels

The amount of funding provided varies again according to the product, the provider and their opinion of the level of risk that your account presents. Typically, 85% is a normal headline rate for core sectors that are often discounted. However, rates can rise to 100% for sectors such as car body repairs and may be higher if other assets are included in the security offered.

Some funders provide a service whereby they will offer to buy your invoices outright at their full value (less the fee for the service).

In sectors such as construction, 70% is a more typical funding percentage.

The actual level of funds advanced may be subject to additional deductions such as debtor credit limits, prime debtor restrictions and disapprovals due to ageing, to name but a few. When choosing a provider, it is very important to understand exactly how they will calculate the level of funding and any restrictions that they will apply. This can be a tricky area about which you should seek advice.

How Much Does Business Invoice Finance Cost?

The costs depend upon the type of facility you want, whether you want any credit control options and the nature of your business. You can choose to get funding against individual sales without any contract, this can cost just a few percentage points of the sale value.

If you want to finance all your sales, via a full book type of facility, the total cost starts from c. £3,500 (+ VAT if applicable) per annum. All-inclusive fees like this are available or you might prefer to have a tariff of charges so that you only pay for the services that you use, both options exist.

If you only want to get funding against one, or a few transactions that you select, the cost can be less. The cost of a selective facility is normally approximately 3 to 5% of invoice values. There may be a small arrangement fee in some cases.

If you have existing quotes or a current facility, please see also: Check My Invoice Finance Pricing Against The Market.

Comparing The Costs

Read our explanation of invoice finance costs. It also has links to pricing examples according to the size of your business and the type of facility that you choose. This will give you an indication of the rates.

If you have existing quotes to compare quotes with, use our Cost Comparison Tool to find out the real estimated annual cost of each price quote.

Compare Invoice Finance Providers

With our network of trusted UK providers, we match you with the most suitable invoice finance options for your needs. You can compare invoice finance companies in one place - we do the research, and you save time and potentially money, with no obligation.

We can provide free, independent support and a quotation search service. To use our service, either make a quote search request or simply call Sean on 03330 113622 to discuss what you need without any obligation to proceed.

Types of Invoice Financing Facility

So, after deciding whether you want to discount all or just some of your sales, there are two principal types of service, both of which can be completely confidential (if you wish) so that no one knows you are using the service:

- Invoice discounting. - this is the "funding only" product, You receive funding against your transactions but retain your own credit control function. Confidential invoice discounting is an option that will also ensure that there are no assignment clauses on invoices, or correspondence in the name of your financier so that your customers are unaware of the arrangement. Bad debt protection is available if you want to protect your business against customers being unable to pay you.

- Invoice factoring - with this service, you receive both the funding against your sales and a credit control support service. This can be a fully comprehensive credit control service so that you don't need to do any of the debt collection yourself. You can save a lot of money by outsourcing this type of function and removing the need to employ credit controllers. Once again, bad debt protection is an option (if you want it).

You can receive any of the above services against all your transactions or just against selected ones.

You can also access export factoring services for sales to export customers abroad.

Who Can Use Invoice Finance?

Any UK company that sells to other businesses (B2B) on credit terms will likely be eligible for a facility. These are some cases where we have helped clients.

Qualification Criteria

If you need help getting a receivables financing facility approved, a broker can help you improve your chances of success.

Eligibility Criteria

The qualification criteria are driven by the type of service that you are seeking. However, the nature of these services is such that some form of funding can be made available to most businesses, regardless of their financial situation. This type of funding can often offer a lifeline to a business that is in trouble with creditor pressure or preferential creditor arrears, e.g. HMRC, VAT, PAYE, NI bills that are due or overdue.

The key is that the provision of finance is based on the strength of your debtor book, i.e. the simplicity of collection of your invoices combined with the creditworthiness and spread of risk amongst your debtors. In this way, the eligibility criteria are not about the strength of your company, but rather your customers.

Read more about When To Use Invoice Finance and our article about Avoiding Rejection Of Your Application before you proceed.

Invoice Finance FAQs

1) What is invoice finance used for?

Invoice finance is typically used to solve cash flow issues by releasing funds tied up in unpaid invoices.

2) How does invoice financing work?

You raise an invoice to your customer, and the finance company advances you a percentage of that invoice. The remainder is paid when your customer settles the invoice (minus fees).

3) Is invoice finance suitable for small businesses?

Yes, many invoice finance providers offer solutions for SMEs, including startups.

4) What's the difference between factoring and invoice discounting?

Factoring includes credit control support, while invoice discounting is usually confidential, and the business manages the credit control.

Further Information About Factoring And Invoice Discounting

Below is some further information about both factoring and invoice discounting:

- How To Finance Business Growth - a shareable infographic that shows the link between using receivables finance and growing your business.

- Short Notice Periods And Open-Ended Contracts Without Notice - an article explaining how short notice periods are now available with both whole turnover and selective facilities.

- List of Invoice Finance Companies - a list of the various factoring and invoice discounting providers within the UK market.

- Market Research - our archive of research and price comparisons regarding business invoice finance.